Prescription medications can be costly, even with health insurance to cut back on some of the expense. While we all have the long-term goal of keeping our finances and ourselves healthy, we also need to think about the short-term goal of getting the medication that we need for ourselves or our family members.

Rather than letting our wallet or emergency fund take a hit every time we get sick or need to refill in a drug in the long run, there are simple steps that we can take to keep from dipping too far in the savings account for prescriptions.

Comparing Costs

When it comes to how much money we spend on prescriptions, don’t assume that all medications cost the same across the board. Your local pharmacy may have a different price than a pharmacy at big-box retailers or grocery stores. In addition to looking at varying prices, be sure to look online for discount coupons or subscription programs for instant savings. Combined with health insurance plans or Medicare coverage, this is a great way to cut some of your overall spendings.

These costs expand to other medical procedures like finding the best hearing aid if you are suffering from hearing loss. When looking for a hearing aid near me, a lot of costs can come with trying to find the right or necessary accessory to benefit your hearing. It starts with getting a hearing test and seeing how much your insurance will cover. After that first step of seeing an audiologist comes the fitting for the hearing device that is best suited for treating your ailment.

When looking for a new hearing aid, look at the options in hearing care provided by varying brands, along with designs and how often such an accessory might be utilized depending on your daily life.

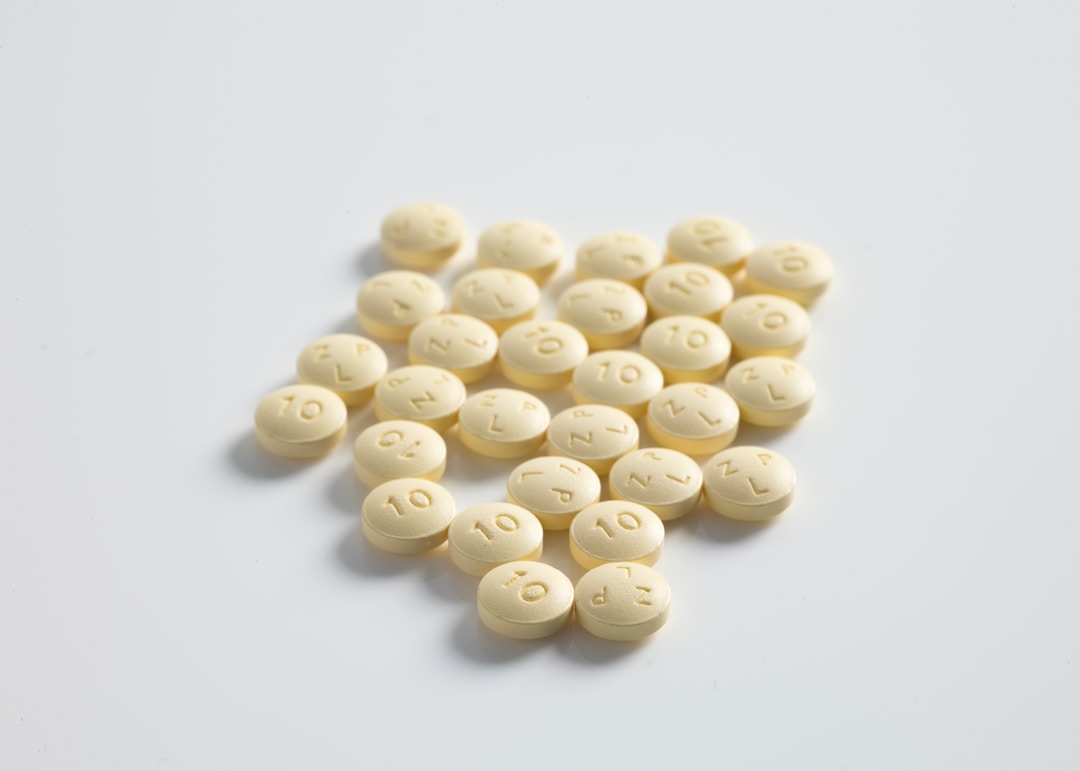

Generic Prescription Options

Name-brand prescription medications taken on a regular basis can really run up your monthly bills. While some people may opt for the meds they get the first time and run with it, it is worth asking your primary care physician or other doctors in your care team about generic medication.

Generic medication provides a cost-friendly option without sacrificing the impact of prescription medication. For example, a drug like Lipitor retails for about $390 for a 30-day supply. The generic version of this cholesterol-lowering drug is Atorvastatin, which actually runs at a cost of 10 to 30 dollars for a 30-day supply.

When it comes to this low price, patients have found it advantageous to stock up on generic brand medications by getting a larger supply. This would mean going from the usual 30-day supply to a 90-day stockpile. There’s even the possibility of adjusting the dosage of the pills you receive, but that must be done in consultation with your healthcare team.

Savings Elsewhere

For some patients, there is no cost too high or too low to assure getting prescription medications. This could lead to cost-cutting measures elsewhere in your budget that could actually help you in saving money in the long run.

Limiting withdrawals from your checking account for fringe purchases can add up and accrue over time. If you don’t need new clothes or have a gym membership that’s going unused, cut the spending and the free money will work in your favor for long-term savings.

Establishing retirement savings from an early age will provide a safety net long-term when some patients begin to see a greater need for prescription medication. Financial goals should also focus on what in your budget has to stay and what has to go. If there are mainstays in your expenses, it may help to look at what could shave a few bucks on your utilities or how much you can set aside from your paycheck to create some savings or an emergency fund.